Hér eru Kķnverjar aš koma sér upp höfnum umkverfis heiminn.

Žar sjįum viš įętlaša höfn į Noršur Ķslandi. Skoša mynd nr 5

Žaš er ekki amalegt aš hafa frķverslunarsamning viš Ķsland.

Kķnverjar geta keypt allt į Ķslandi į viku.

Ķslendingar geta keypt örsmįtt smįbrot af Kķna.

Kķnverjar hafa nś žegar tekiš lögsögu langt inn ķ lögsögu annarra žjóša,

upp ķ 800 kķlómetra ( vegalengdin frį Ķslandi til Skotlands, er 1000 Kķlómetrar )

sušur aš Filipseyjum, Malasyu, Brunei og vestur til Vietnam. sem eru miklu stęrri og fjölmennari en Ķsland.

Kķnverjar fara žarna ekki eftir alžjóšlegum hafréttar reglum.

Viš į Ķslandi veršum aš lęra aš skoša samhengiš ķ samskiptum okkar viš žjóširnar.

Einkum samskiptunum viš Stóržjóširnar.

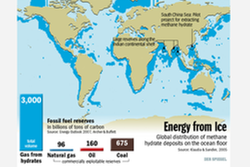

Noršaustur af Ķslandi eru einhverjar mestu orkulindi heimsins, Crystal Methane.

Žessi setlög eru į milli Ķslands, Gręnlands, Rśsslands og Noregs. Skoša mynd nr 3

Ķ Indlandshafi hafa fundist Crystal Methane setlög, 132 metra į žykkt.

Kķnverjar eru aš reyna aš stašsetja sig viš žessar orkulindir. Skoša myndir, nr 3

000

Arctic Ocean methane does not reach the atmosphere

https://www.sciencedaily.com/releases/2016/05/160527112654.htm

nr 1

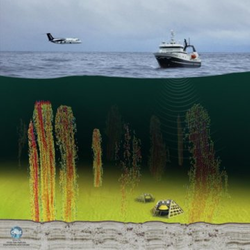

Ocean floor observatories, research ship and airplane were deployed to a area of 250 active methane gas flares in the Arctic Ocean.

000

China, India, South Korea, Japan and Taiwan all are expressing a large interest in and financial commitment to developing a harvesting infrastructure for this promising resource. Žetta er įstęša deilunar um Sušur Kķna haf.

29.4.2017 | 01:44

China and India To Harvest Massive New Fuel Source: Crystal Methane Jason Mick (Blog) - December 14, 2007 5:08 PM

China, India and numerous other developing nations bet on new carbon fuel to complete their ascent to economic dominance

Klikka, stęrri mynd

nr 2

Žeir bįru eld aš botnfallinu, setinu af hafsbotninum, og gasiš lekur śr kristöllunum, sem eru eins og svampur, og sjśga ķ sig gasiš.

Here the methane hydrate trapped within the muddy sediment is showed fueling a golden flame. Methane hydrate resources are estimated to surpass coal, oil, and natural gas supplies combined. (Source: Spiegel Online)

Klikka, fį stęrri mynd

nr 3

Hér er blįi liturinn, staširnir žar sem mest er af setinu, sem er fullt af orku.

Žetta er įstęšan, aš Kķna reynir aš yfirtaka Sušur Kķna haf, 800 kķlómetra ķ suš vestur aš ströndum Vķetnam, Malaysiu , Brunei og sušur aš Filipseyjum.***

There are rich deposits of methane hydrates surrounding much of Asia. (Source: Spiegel Online)

... China, India, South Korea, Japan and Taiwan all are expressing a large interest in and financial commitment to developing a harvesting infrastructure for this promising resource. While the west has only expressed marginal interest in it, these Asian nations see it as an invaluable tool to pass their western competitors which they are fast approaching in terms of economic power. ...

... Fossil fuel prospecting companies are considering using drilling and heating pipes to melt the crystals and release the methane, which will be subsequently captured.

China is not alone in its zealousness for the fuel. Japan built the world's largest research drilling ship to aid in its prospecting chances and India has invested almost 300 million USD to begin a national program of methane prospecting and harvest. India has achieved a significant early success, discovering an extremely thick 132 m methane-hydrate containing layer of sediment has been found in the Krishna-Godavari Basin in the Indian Ocean. ...

slóš

14.6.2016 | 16:09

Klikka, stęrri mynd

nr 4

Egilsstašir, 29.04.2017 Jónas Gunnlaugsson

000

China’s expanding investment in global ports

China is making strides towards establishing itself as a maritime power. Besides enhancing the capabilities of its navy, it is also investing heavily in global port infrastructure. From mid-2016 to mid-2017 Chinese firms announced around US$20bn-worth of investment in nine overseas ports, around double that for the year-earlier period. However, several political and economic risks have to be navigated to ensure that this investment delivers returns.

The pace of China's investment in port infrastructure has been picking up. Based on The Economist Intelligence Unit's research, Chinese companies had confirmed seaport investments or port ownership in 34 countries by September 2017, with 12 planned investments in another eight countries.

nr 5

State-owned enterprises (SOEs) have been the main investors in overseas ports. The pioneer was state-owned COSCO Shipping, the country's biggest shipping line. It has focused on acquiring ports at key nodes within global shipping routes, such as Piraeus (Greece), Euromax (Netherlands) and Said (Egypt). Most of its port investments are in developed countries.

Another SOE, China Merchants Group, is a relative latecomer, but is investing heavily in emerging markets. By end-2016 the company owned or had operational rights to 40 ports in 22 countries, including Nigeria, Sri Lanka, Togo and Djibouti, based on our research. Even in the US, where ports are often off-limits for foreign investors, China Merchants has acquired small stakes in ports in Houston and Miami by buying Terminal Link, a French shipping line.

Most existing or planned investments by Chinese companies have been in deep-sea ports. Since the 2008–09 global financial crisis, the world's merchant fleets have developed ever-larger shipping vessels in order to reduce costs. Deep-sea ports servicing these vessels are more likely to prosper.

Three "blue economic passages"

Planned port investments are mostly along three "blue economic passages", an initiative announced by the National Development and Reform Commission, China's top economic planner, that aims to connect Asia with Africa, Oceania and Europe under the banner of the Belt and Road Initiative (BRI).

The main focus of attention is the "passage" running from China to the Indian Ocean, Africa and onto the Mediterranean. This is tied to other flagship BRI projects, such as the China-Pakistan Economic Corridor and the Bangladesh-China-India-Myanmar Economic Corridor. Along this route, Chinese companies have already made port investments in Gwadar (Pakistan), Colombo and Hambantota (both in Sri Lanka). Four different initiatives are planned for Malaysia. Plans to invest in Tanjung Priok (Indonesia) and Kyaukpyu (Myanmar) are also under negotiation.

The second passage connects with Australia and the Southern Pacific. Australia is the second-largest recipient of accumulated Chinese overall investment. Chinese companies have invested in ports in Darwin, Newcastle and Melbourne. The Port of Darwin exports 35% of Australian livestock and the Port of Newcastle exports 40% of Australian coal; China is a major importer of both products.

The third passage, connecting China with Europe via the Arctic Ocean, is less developed but potentially significant as it could cut shipping times by several days. Planned Chinese-backed projects, under negotiation or bidding, include port investments in Arkhangelsk (Russia), Klaipeda (Lithuania), Kirkenes (Norway) and a deep-sea port in a fjord in northern Iceland.

Why ports?

There are obvious economic benefits that explain China's investment in port infrastructure. China is the world's largest exporter and second-largest importer—its economy is intertwined with global trade. Japan in the 1980s and South Korea in the 1990s also invested heavily in overseas ports as they expanded their global trade footprint. China sees particular potential in developing economies, where trade growth is likely to be strongest in the coming years.

Besides facilitating trade, ports provide broader economic value, such as valuable data on logistics and the local economy. They offer an opportunity to develop related maritime services—including insurance, consulting and the compilation of key industrial indices. Port construction also offers a release valve to China's construction and machinery sectors, which are both suffering from domestic overcapacity. According to local media, China Communications Construction, the world's largest port-building company, had built 95 deep-water berths and sold over 750 shipping container cranes outside China by end–2016.

More controversially, there are strategic advantages from port investment, too, as they bring with them tighter control of key sea lanes and energy supply routes. China's interest in Gwadar, which the state-owned China Overseas Ports has operated since 2013, stems from the opportunity it provides to transport crude oil from the Middle East to western China without having to transit through the Strait of Malacca. There are also potentially military uses from port development, such as the case for ports in Gwadar, Djibouti and the Seychelles. While Colombo and Piraeus have not received official confirmation, they have both had high-profile visits from the Chinese navy.

000

Djibouti President: China Negotiating Horn of Africa Military Base

000

China's naval efforts may prove wanting in front of Indian Navy's experience

Read more at: //economictimes.indiatimes.com/articleshow/57575868.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

nr 6

Image Source- Center for Strategic & ..

Read more at: //economictimes.indiatimes.com/articleshow/57575868.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

000

Looking for China’s maritime militia

http://www.aljazeera.com/blogs/asia/2016/06/chinas-maritime-militia-160603205135196.html

nr 7

000

China Warns US To Think Again And Not Stir Trouble As US Navy Sails Close To Disputed Islands In South China Sea

nr 8

Chinese dredging vessels are purportedly seen in the waters around Fiery Cross Reef in the disputed Spratly Islands in the South China Sea in this still image from video taken by a P-8A Poseidon surveillance aircraft provided by the United States Navy May 21, 2015. Photo: U.S. Navy/Handout via Reuters

000

Report: Chinese Navy’s Fleet Will Outnumber U.S. by 2020

3 Dec 2014 By Kris Osborn

nr 9

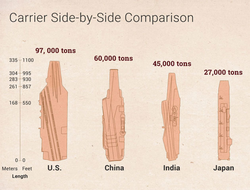

China has plans to grow its navy to 351 ships by 2020 as the Chinese continue to develop their military’s ability to strike global targets, according to a new report

000

Egilsstašir, 29.01.2018 Jónas Gunnlaugsson

*

Žaš vantar hugleišslu Öldungarįš, konur og karlar, meš Lķnu langsokk, og reyna aš nįlgast kjarnann, The core, hans Nikole Tesla.

Rįšiš mį alls ekki vera starfssamt, eins og fréttamennirnir lżsa Alžingi stundum.

Alžingi į aš henda śt vitlausum lögum, og ef virkilega žarf, žį stutt og einföld lög.

Ég man ekki hvaš Trump sagši, henda śt žrem reglugeršum ef į aš bęta einni viš.

Hann hefši žurft aš segja aš hver nż reglugerš, yrši aš vera 50% minni en mešaltališ af žeim sem hent vęri śt.

agny

agny

Bęta viš athugasemd [Innskrįning]

Ekki er lengur hęgt aš skrifa athugasemdir viš fęrsluna, žar sem tķmamörk į athugasemdir eru lišin.